All Categories

Featured

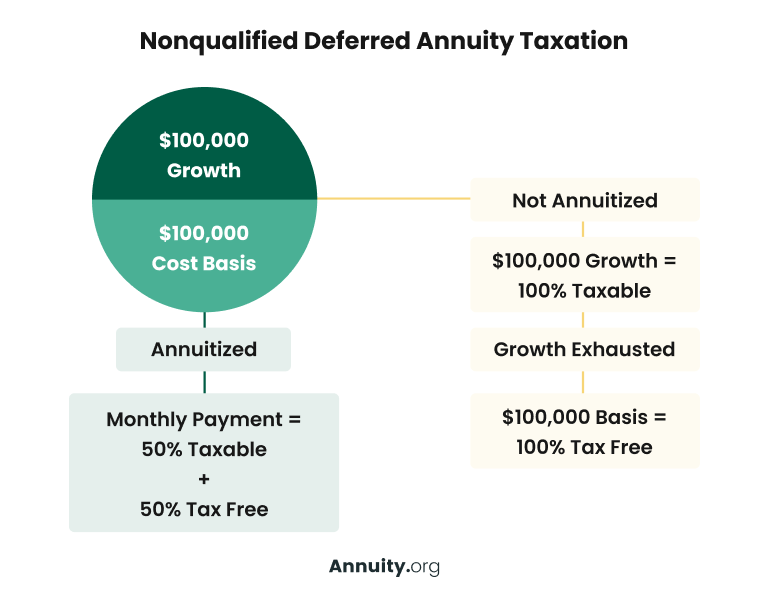

The finest option for any kind of person ought to be based on their existing scenarios, tax obligation situation, and monetary purposes. Annuity interest rates. The money from an acquired annuity can be paid out as a solitary lump sum, which comes to be taxable in the year it is received - Long-term annuities. The drawback to this choice is that the revenues in the agreement are distributed initially, which are taxed as normal earnings

The tax-free principal is not paid up until after the profits are paid out.: The beneficiary can ask for that the earnings be annuitizedturning the cash right into a stream of income for a lifetime or a collection amount of time. The benefit is the payments are only partially taxed on the passion portion, which implies you can postpone tax obligations well into the future.:

Likewise described as the Life Span or One-year Rule, the nonqualified stretch option utilizes the beneficiaries staying life span to compute a yearly required minimal distribution. The following year, the staying quantity of money is split by 29, and so on. If there are numerous beneficiaries, each one can utilize their very own life span to compute minimal distributions. With the stretch option, recipients are not limited to taking the minimal circulation (Fixed annuities). They can take as long as they want up to the entire remaining capital. If you don't have an instant requirement for the cash from an acquired annuity, you might pick to roll it into one more annuity you regulate. With a 1035 exchange, you can route the life insurance firm to transfer the money from your inherited annuity into a new annuity you develop. By doing this, you remain to postpone tax obligations until you access the funds, either through withdrawals or annuitization. If the inherited annuity was initially established inside an individual retirement account, you could trade it for a certified annuity inside your own individual retirement account. Inheriting an annuity can be an economic benefit. However, without thoughtful factor to consider for tax obligation

effects, it can be a breast. While it's not possible to totally stay clear of tax obligations on an inherited annuity, there are numerous ways to lessen existing tax obligations while taking full advantage of tax deferral and boosting the lasting worth of the annuity. Moreover, you ought to not think that any kind of discussion or details had in this blog site works as the invoice of, or as an alternative for, customized investment advice from DWM. To the degree that a reader has any kind of inquiries concerning the applicability of any kind of details concern reviewed over to his/her specific situation, he/she is urged to talk to the specialist consultant of his/her choosing. Shawn Plummer, CRPC Retired Life Organizer and Insurance Agent: This individual or entity is first in line to get the annuity survivor benefit. Calling a key beneficiary aids stay clear of the probate process, enabling a quicker and a lot more direct transfer of assets.: Ought to the primary recipient predecease the annuity proprietor, the contingent beneficiary will obtain the benefits.: This option enables beneficiaries to receive the entire staying value of the annuity in a solitary payment. It gives immediate accessibility to funds however may lead to a substantial tax obligation worry.: Beneficiaries can decide to receive the fatality advantagesas continued annuity payments. This option can use a stable revenue stream and might aid expand the tax obligation responsibility over several years.: Unsure which survivor benefit option offers the most effective financial outcome.: Anxious concerning the possible tax obligation implications for recipients. Our group has 15 years of experience as an insurance company, annuity broker, and retired life coordinator. We understand the stress and unpredictability you really feel and are dedicated to assisting you discover the ideal service at the lowest costs. Screen modifications in tax obligation legislations and annuity laws. Maintain your strategy up-to-date for recurring peace of mind.: Customized guidance for your one-of-a-kind situation.: Comprehensive testimonial of your annuity and recipient options.: Minimize tax obligation responsibilities for your beneficiaries.: Continuous surveillance and updates to your strategy. By not collaborating with us, you risk your beneficiaries encountering considerable tax worries and financial difficulties. You'll feel great and reassured, understanding your beneficiaries are well-protected. Contact us today free of charge recommendations or a complimentary annuity quote with boosted survivor benefit. Obtain annuity survivor benefit aid from a certified economic specialist. This solution is. If the annuitant passes away prior to the payment period, their beneficiary will certainly get the quantity paid right into the plan or the cash worth

How are beneficiaries taxed on Multi-year Guaranteed Annuities

whichever is greater. If the annuitant passes away after the annuity beginning day, the recipient will generally remain to receive settlements. The response to this question depends on the sort of annuity youhave. If you have a life annuity, your settlements will certainly end when you die. If you have a specific annuity term, your payments will continue for the specified number of years, also if you pass away before that period finishes. So, it depends on your annuity and what will occur to it when you pass away. Yes, an annuity can be handed down to beneficiaries. However, some regulations and policies need to be complied with to do so. First, you will require to call a beneficiary for your annuity. This can be done when you first purchase the annuity or after that. No, annuities usually stay clear of probate and are not component of an estate. After you pass away, your beneficiaries should get in touch with the annuity business to start receiving repayments. The firm will certainly then generally send out the settlements within a few weeks. Your beneficiaries will certainly get a round figure repayment if you have a postponed annuity. There is no set period for a beneficiary to claim an annuity.

Annuity recipients can be contested under certain situations, such as disagreements over the credibility of the recipient designation or insurance claims of unnecessary impact. An annuity death advantage pays out a set quantity to your recipients when you die. Joint and beneficiary annuities are the two kinds of annuities that can avoid probate.

Latest Posts

Understanding Financial Strategies Key Insights on Fixed Interest Annuity Vs Variable Investment Annuity Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Fixed Annu

Highlighting Retirement Income Fixed Vs Variable Annuity A Comprehensive Guide to Investment Choices What Is Fixed Annuity Vs Equity-linked Variable Annuity? Features of Fixed Vs Variable Annuities Wh

Breaking Down Fixed Vs Variable Annuity Pros Cons A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing the Ri

More

Latest Posts